Will biotech shine through a recession?

No one doubts that the stock market has been taking hit after hit for the past year, with the Nasdaq 100 dropping nearly 33%. But, if you look closely enough, you might see a sliver of hope: the biotechnology sector.

Biotech’s sudden uptick doesn’t come as a surprise, however. As the economy takes a downturn, there are a few reasons why analysts and investors think biotech will soar throughout the recession.

The Glooming Recession Around the Corner

Unfortunately after 2+ years of instability due to Covid-19, it doesn’t look like the U.S. economy will see better days ahead. With interest rates rising over three-quarters of a point, inflation on the rise, and a war happening overseas in Ukraine, it seems that a recession is just around the corner for the United States.

In an attempt to curb the staggering inflation we’ve seen throughout 2022, the federal funds rate was hiked from June through September. What this means for biotech companies (as it does for all other companies too) is that borrowing money from the government for growth and innovation - which are the bread and butter of biotech companies - becomes substantially more expensive.

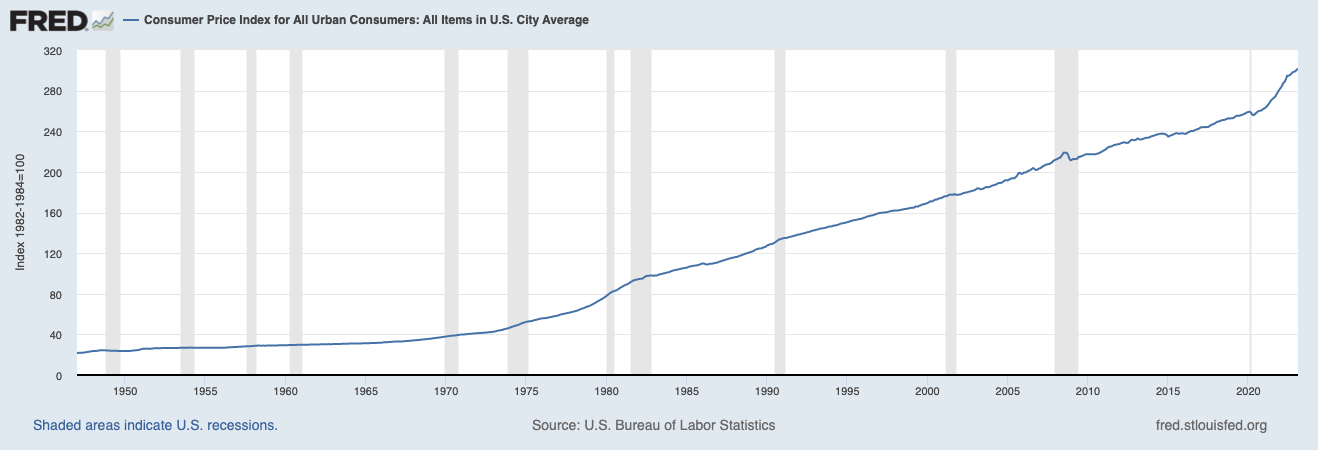

An additional reason for the staggering inflation we’ve been experiencing is the economic sanctions placed on Russian oil and gas as well as disruptions in the supply chain throughout Asia. This is causing consumers to bear the burden of increased costs of everyday commodities. The Consumer Price Index, a measure of the average change over time in the price for a market basket of goods, has increased 9.1% from June 2021 to June 2022, the largest 12-month increase since November 1981.

Biotechnology in Past Recessions

It comes as no surprise that no industry or sector is immune to a recession - including biotechnology. Luckily for those in the biotechnology sector, however, is that biotech is working on problems that are changing the world and saving lives. What this means is that despite economic volatility and downturn, people still need to buy their medicine.

Throughout the 2001, 2007 through 2009, and the current recessions, biotechnology indexes have outperformed the market as a whole. Let’s take a look at 2001, when the S&P500 fell by 8% while the NYSEArca Biotech Index (BTK) rose by 4%. If you fast forward to December of 2007, the S&P500 dropped by 37% with the BTK bottoming out at a decline of only 11% - quite the difference. Throughout these three economic downturns, indexes tracking biotechnology declined just 1%, while pharmaceutical indexes dropped 10% and the S&P500 dropped 20%.

This year is no different for biotech. So far, we’ve been seeing biotech indexes outpace the rest of the market. As of this writing, the S&P500 is down nearly 20% year-to-date, while the BTK is down just 8%, and yet the iShares Nasdaq Biotechnology ETF (IBB) is up just over 2%.

When looking back at previous years when the economy has taken a hit, it’s clear that biotech indices have outperformed the market as a whole. Our assumption as to why? Biotechnology startups are changing the world

Why Investors are Bullish on Biotech

Despite the rest of the market seeing a major downturn, investors have a few reasons to be optimistic about the biotech industry. As mentioned before, despite the impending recession people still need access to their medicine and lifesaving treatment, making the sector as a whole more defensive against the overall status of the economy. What this means is that the biotech industry is impacted largely by technological and demographic changes rather than what is happening in the market.

It’s true that the biotech industry still needs to fair against rising interest rates and inflation, but what’s been helping to keep the industry afloat is the continuous release of good clinical news. Right now in the U.S., there are over 16,000 active clinical studies occurring, this is an increase of more than 17% since 2021.

If that wasn’t enough, acquisitions by Big Pharma companies along with strong earnings reports have helped biotech stocks climb to the top while other industries aren’t so fortunate.

Biotech Battles the Recession

In short, despite a recession, the biotech industry is here to stay and maybe even prosper. A bear market is the time to build a strong product, and now might be the right time for you. SciMed is your go-to partner for building a great product to help solve the world's toughest challenges.